Abstract The speed of automation of accounting functions constitutes the biggest challenges to accounting professionals. Accounting has evolved from manual ledgers to computerized systems, ERP’s and now digitization. Hence accountants have faced gradual automation of the functions they have assiduously studied and mastered. The latest wave includes robotics, machine learning and artificial intelligence (AI). How accountants adapt to the use of technology and cater to requirements for information, big data analytics and forecasting will define the successful next-gen accountant. With an increasingly connected world, the risks of fraud and cybercrime are unprecedented. Increased regulation and stronger governance, with increased globalization, will significantly impact the profession. The challenges will require future accountants to be embrace technology in order to create space to collaborate and partner the business; interpret the numbers; provide insight and become more involved in decision-making. Communication skills, process design and above all integrity, will be key attributes of the future accountant. A Challenging Landscape for Future Accountants Development of intelligent automated accounting systems The years have seen gradual automation of traditional tasks of an accountant. Computerized systems took over double entries, ERPs now generate the trial balance and financial statements, debtors follow up is automated through dunning, bank reconciliations happen with minimal human intervention through integration between banks and ERPs, and even cashflow statements and notes to the accounts are system generated. Current developments include

- Increasing use of OCR (Optical Character Recognition) and ICR (Intelligent Character Recognition), through which supplier invoices are captured by automated accounting systems and Accounts Payable is increasingly becoming “touchless”. Machine learning is inbuilt with OCR applications and the system “learns”. Any corrections applied to the automatic character reading of the system, are stored and applied in future documents, thus progressively increasing levels of accuracy

- Some Nordic countries mandating paperless transactions. Systems which integrate seamlessly with the ERP systems connect the customer and supplier and enable the supplier’s invoice to flow through electronically into the customer’s books. Rates are automatically validated against contracts by the system.

- Balance sheet reconciliations are carried out by through automated reconciliation systems

- RPA (Robotic Process Automation) is used to automate repetitive rule-based tasks which follow a set sequence of activities. A bot can pull information from one system, manipulate it, make decisions, and put the data or result into another system. Any manual, repetitive task where decisions can be reduced to a series of rules or solved by an algorithm can be automated in this way. Bots are increasingly used to carry out a variety of accounting functions and are one of the main topics of discussion in Accounting, Shared Services, and BPO forums. Shared Services Centres in Sri Lanka too have commenced use of Bots to automate a range of functions. The advantage for companies in the use of bots includes, a bot never falls sick, has zero absenteeism and days off, works 24 x 7 and performs predictably and accurately.

- AI (Artificial intelligence) is rendering rule-based decisions possible for more advanced bots.

- In the area of audit, big data analytical tools can analyse large volumes of data, apply a combination of statistical models and tests, and flag exceptions instantaneously for review. The John Keells Group has adopted the use of such a tool called “Forestpin” which is used to identify irregularities using Benford’s law, correlation, time series and duplicate analysis.

- Specialist audit systems have digitized working papers, select sample sizes statistically and carry out automated tests

- Decision support systems can simulate a variety of scenarios and churn out what-if analysis and predictive analysis

- Expert systems on tax will be able to automate tax computations based on currently applicable tax laws. These systems consist of a knowledge base, inference engine, and user interface

Thus, knowledge and skills developed assiduously over the years by aspiring accountants are increasingly obsolete and carried out by automated “smart” systems. Could these render accountants redundant? Those who are less IT savvy, stick to the status quo, are in a comfort zone and fear change risk their skills becoming obsolete. In this backdrop how does the accountant of the future reinvent the role to remain relevant? The rise of Cyber-Crime The increasing use of internet-based systems and the cloud, online transactions, the requirement for flexibility and use of multiple communication devices, bring with them an unprecedented rise in cybercrime and hacking. Internationally, some of the most secure systems and organisations ranging from the Pentagon, leading banks, to Yahoo and iCloud have been subject to hacking; leading corporates and banks in Sri Lanka experience multiple hacking attempts on a daily basis. Already institutions have faced theft of sensitive data, large financial losses due to exploiting Accounts Payable and Accounts Receivable processes, shutting down of critical systems, loss of important information to ransomware attacks. In this backdrop, accountants must remember their core responsibility of safeguarding a company’s assets and ensure adequate controls and design of processes to mitigate risk. Globalisation, Regulation, and Governance Increased regulation and stronger governance will have the greatest impact on the profession in the years to 2025. All members of the profession will be affected directly or indirectly and to varying degrees. For example, professional accountants in many roles and countries will be affected by intergovernmental tax action to limit base erosion and profit shifting. The Future Accountant will need to keep abreast and ensure compliance with ever-increasing regulation and governance requirement. The regulations and compliance include

- Complex accounting standards, oftentimes IFRS as well as myriad local standards

- NOCLAR (Non-Compliance with Laws and Regulations)

- FATCA (Foreign Account Tax Compliance Act)

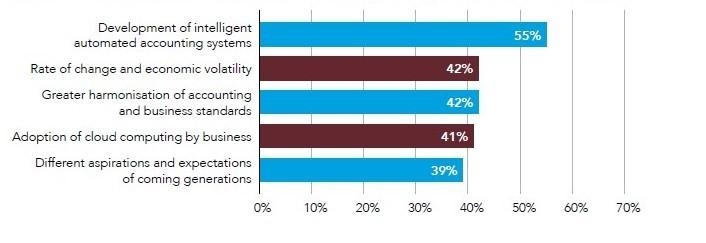

Continued globalisation will present challenges to those future accountants. Professional accountants will need to anticipate and accommodate emerging differences in business practices, geographies, roles, responsibilities and regulations and to develop the necessary technical knowledge, skills, and ethics, in addition to displaying interpersonal behaviours and qualities. Accountants will need to be sensitive to cultural diversity. Being multilingual, understanding different countries and cultures, and having the interpersonal skills to work as part of and manage diverse teams will eventually become as important as technical skills in the decisions made about recruitment and deployment. Globalisation, together with regulations continually becoming more stringent, will challenge finance professionals to develop a variety of new skills, knowledge and continuous learning and development. Findings In 2014 and 2015, ACCA undertook global qualitative and quantitative research into the changes that professional accountants are likely to face up to 2025 and the skills needed to enable them to help organisations to sustain economic growth and to compete nationally and internationally. ACCA engaged with over 2,000 professional accountants and C-suite executives across the globe to identify the external factors that they expect to have the greatest impact over the next 3 to 10years. The findings showed 55% of those surveyed ranked the development of intelligent, automated accounting systems to have the highest impact.

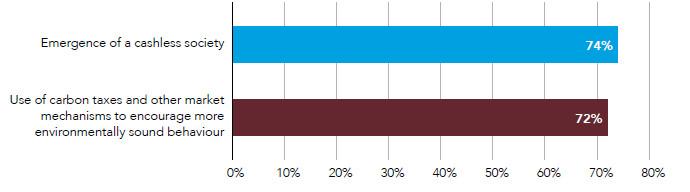

Figure 1: External factors expected to have the highest impact in the next 3 to 10 years Beyond 2025, the two factors expected to have the highest impact include changes in the direction of global governance and changing societal expectations and the evolution of the role of the accountant.

Figure 2: External factors expected to have the highest impact after 2025 ACCA research finds that in the area of audit and assurance knowledge of digital technologies tops the list of competency areas where professional accountants believe there are key skills gaps, followed a distant second by communication skills, with third on the list taken jointly by sector knowledge, business awareness, and a global perspective. The research finds that audit firms are expanding technology use and expertise, particularly analytics. Nonetheless, a Google search can reveal more data than any assurance report. By 2020, stakeholders with internet access will have the tools to analyse ‘big data’. By 2025, Google may employ more audit and assurance professionals than the Big Four. In the area of financial management, future accountants would need to explain financial strategy and performance, defend investments and manage the conflicting expectations of stakeholders both inside and outside the organisation. Teamwork, language skills, multicultural awareness and the ability to collaborate, influence, persuade, speak articulately and present to others inside and outside finance will be vital for all tomorrow’s financial managers (and aspiring financial managers). Future Skills ACCA’s research findings are that professional accountants of the future will need a new combination of professional competencies, comprising of technical knowledge, skills, combined with interpersonal behaviours and qualities. These are summarized into seven areas:

- Technical skills and ethics (TEQ):

The skills and abilities to perform activities consistently to a defined standard while maintaining the highest standards of integrity and independence.

- Intelligence (IQ):

The ability to acquire and use knowledge: thinking, reasoning and solving problems.

- Creative (CQ):

The ability to use existing knowledge in a new situation, to make connections, explore potential outcomes, and generate new ideas.

- Digital (DQ):

The awareness and application of existing and emerging digital technologies, -capabilities, practices and strategies.

- Emotional intelligence (EQ):

The ability to identify your own emotions and those of others, harness and apply them to tasks, and regulate and manage them.

- Vision (VQ):

The ability to anticipate future trends accurately by extrapolating existing trends and facts, and filling the gaps by thinking innovatively.

- Experience (XQ):

The ability and skills to understand customer expectations, meet desired outcomes and create value. Conclusion The use of smart accounting systems and increasing automation will replace many traditional functions of accountants. In order to succeed in the new environment future accountants must reinvent their role as business advisors, embrace technology and master new knowledge and skills. Knowledge of digital technologies, big data analytics and designing of controls against cyber-crime will be paramount. Communication skills and development of the professional quotients, vision, creativity, emotional intelligence, together with strong ethical competencies will be key determinants of success for the future accountant. Acknowledgements I would like to acknowledge the extensive research work and efforts of the Association of Chartered Certified Accountants (ACCA) in their pioneering work on Drivers of change and future skills. References ACCA (2016) Professional Accountants – the future: Drivers of Change and Future skills Blackline, Robotic Accounting Department